Become a member of the cashback bonus program from PSB | Spend the accumulated points on paying for goods and services of partners, accounts in the Internet bank

Cashback program

Simple reward calculation: 1 cashback point = 1 ruble.

Clear rules for accruing points for card purchases (% of the amount).

Transfer to rubles of any number of points, without a minimum threshold.

Up to 10% cashback in selected categories is credited for flagship cards.

To get the maximum cashback, issue a card from the new flagship line: payroll, credit or debit, and you will automatically become a member of the bonus program!

How it works?

Connect to the Cashback program if you already have a PSB card.

Pay for goods and services with a PSB card.

Get points on your bonus account for every 100 rubles spent.

Exchange points for rubles at the rate of 1 point = 1 ruble.

Rubles will be credited to your card account

Card Your Cashback

Choose your privilege:

— 1.5% cashback on all purchases

— 4% on the balance

— up to 5% cashback in three selected categories and 1% on other purchases

Salary card Your Plus

– Cashback up to 7%

– Up to 5% on the balance of the card account

– Free withdrawals from ATMs of any bank up to 150,000 rubles per month

– Payments and transfers without commission up to 100,000 rubles per month

Double cashback card

A map that is always at hand! Cashback is credited not only for all your daily purchases, but also for replenishing the card.

About the bonus program

Scoring

The number of points is calculated as a percentage of the purchase amount. Points are awarded for every full 100 rubles spent.

Points are credited to the unified bonus account once a month no later than the twentieth calendar day of the month following the reporting one.

Only the first five transactions made in one trade and service enterprise during the day are taken into account.

Each card has its own scoring rules. The maximum number of points that can be awarded per month:

- Your cashback (debit) – 3000 points;

- Double cashback (credit) – 2000 points;

- Your plus (salary) – 5000 points;

- Strong people. Special Purpose Tariff (salary) — 5000 points;

- Salary-PRO (salary) – 3000 points;

- On the move (debit) – 3000 points;

- Retirement card, Card for military pensioners – 3000 points.

Special conditions

Points are awarded for paying with a card for goods or services in any stores around the world, including online stores. Double Cashback, Your Cashback and On the Move cards allow you to get more points for purchases in special categories.

Your cashback

— 1.5% cashback on all purchases

— 4% on the balance

— up to 5% cashback in three selected categories and 1% on other purchases

With a total amount of purchases from 5000 ₽ per month

Double Cashback

— 10%, 7%, 5% within the selected package of privileges

— 1% for other purchases, for repayment of card debt

With a total amount of purchases from 10,000 ₽ per month

Your Plus

– up to 7% for purchases in 3 categories of your choice

or

— 5% per annum of the amount of the average monthly balance

– 1% for other purchases

With a total amount of purchases from 5000 ₽ per month

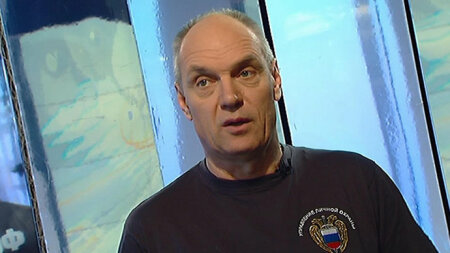

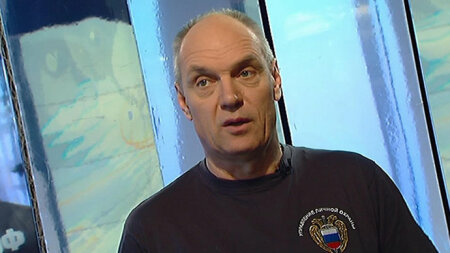

Strong people. Special purpose tariff

— up to 4% for purchases in 3 categories (pharmacies, gas stations, supermarkets)

– 1% for other purchases

or

— 4% per annum of the amount of the average monthly balance

With a total amount of purchases from 5000 ₽ per month

Salary-PRO

— 1% for purchases

With a total amount of purchases from 15,000 ₽ per month

Retirement card, Card for military pensioners

3% for purchases at gas stations and pharmacies

Spending points

Exchange points from your bonus account for rubles and withdraw funds to your card account. As part of the Cashback program, there is a single rate: 1 point = 1 ruble.

There is no need to accumulate a minimum number of points for the exchange. You can only withdraw a whole amount of rubles to the card account.

Changes and clarifications in the terms and conditions

- From May 1, the following changes to the Terms of the bonus program come into force:

— using the card Double cashback: in order to receive points for replenishing the card, it is necessary to make purchases with the card in the amount of 30,000 rubles or more within a month.

– for Pension cards and cards at the United No. 7 tariff, cashback is credited if one of the conditions is met: crediting to a pension card, or making purchases with a card in the amount of 5,000 rubles or more. In addition, if a pension is credited to a pension card, customers receive an additional cashback in the “Pet Products” category.

- Prolong Summer promotion for Strong People. Special Purpose Tariff.

In the period from 09/01/2021 to 11/30/2021, the cashback increases to 2% of the transaction amount when paying for Air and railway tickets (MCS transaction codes 4112, 4511, MCC 3000–3299), regardless of the selected additional Reason: categories of increased accrual of Points or Points for account balances.

- On August 16, 2021, the TNS-ENERGO loyalty program is closed. The last accrual of Energy Points will take place on August 01-15. And before September 20, 2021, the Energy points available to customers will be automatically converted into rubles at the rate of 1 point = 1 ruble with crediting to the card account.

- From April 1, 2021, the following changes to the bonus program will come into effect:

For cards on the tariffs Your cashback (issued before 09/09/2020), Your cashback promo, Your cashback plus, 1% cashback for purchases outside the categories of increased points accrual will be credited only if the client has chosen any of the bonus options. In addition, the interest rate on the balance option is reduced to 4%.

Privilege package Leisure

10% — taxi / carsharing

7% – cinema

5% – cafes and restaurants

Privilege package Family

10% – public transport

7% – pharmacies

5% – house and renovation

Privilege package Auto

10% – payment of traffic police fines * in the Internet / Mobile Bank PSB (a commission is charged for the operation in accordance with the tariff)

7% — maintenance and car washes

5% – gas stations

Activation of the privilege package is free of charge.

You can change the package of privileges at any time via the PSB Internet/Mobile Bank or via the Bank's Contact Center. A fee of 990 rubles is charged for changing the package of privileges.

Double cashback: points (for transactions and debt repayment) will be accrued when the amount of purchases on the card is at least 10,000 rubles per month.

Orange Premium Club: Cashback of 0.25% and 1% is cancelled. Only 5% Cashback will be credited for the categories selected by the participant. Cashback 10%

2. 1% cashback is credited in other categories, including transactions included in the increased cashback categories, if:

— on the date of writing off the transaction, the credit limit was not issued;

— the amount of the debited transaction exceeds the amount of the issued credit limit.

3. 1% cashback is credited to the account replenishment amount written off to pay off the debt.

For example, if you deposited 1800 rubles to the Double Cashback card, and the debt is 500 rubles, then 1% is charged to you only for the amount of the repaid debt of 500 rubles, 500 * 1% = 5 points. Debt repayment does not include commissions for annual maintenance and the service SMS-informing about performed transactions.

Promsvyazbank customers can participate in the new cashback bonus program.

PSBonus members who have not received an email or SMS about being transferred to the cashback program can connect to the new program in the Internet bank, at the Promsvyazbank office or by calling the contact center 8 (800) 333 0303.

We decided to simplify our PSBonus program, make it clearer and more convenient. To do this, they created a new loyalty program, which is simply called cashback.

Owners of new Double Cashback credit cards and Your Cashback debit cards are already connecting to it. We plan to include PSBonus participants in the same program.

The new program does not have a complex system of levels of participation and different rates of utilization of points. One point is equal to one ruble. And points are awarded once a month as a percentage of completed transactions. Accumulated points can be converted into rubles at any time and credited to the card account.

For the first half of May 2018, we have planned an automatic transfer to the new program of PSBonus members who own On the Move cards, as well as everyone who has debited bonus points since January 01, 2017 or joined the program since June 01, 2017.

Clients don't have to do anything. We will automatically convert their bonus points into points of the new cashback program. We will announce the date of the transition to the new program in an SMS message.

Bonus points will be converted into the new program at the same rate that is valid today for the use of points in PSBonus (see table). For those whose bonus savings are close to 50,000 points, we have prepared a pleasant surprise. At the best rate (1 PSBonus point = 0.10 cashback points), accumulations from 45,000 points will be converted.

When switching from the PSBonus program to the cashback program, points are converted within 24 hours from the moment the participant connects to the new program.

Bonus savings conversion rate

In Nizhny Novgorod and the Nizhny Novgorod region:

1. Excluded templates: HOA Poltava Dvorik, st. Poltavskaya, 3 (operation 4871 in PSB-Retail Internet bank) and HOA No. 454 (operation 5291 in PSB-Retail Internet bank)

2. Changed the TSN template number Sodruzhestvo 292 (N.Novgorod) in PSB-Retail internet bank from 10229 to 10996.

3. Changed the number of the HOA template Nizhegorodets-1 in the PSB-Retail Internet Bank from 10026 to 10973.

4. Changed the template number of the HOA Poltava in the Internet bank PSB-Retail from 10008 to 10972.

Points are awarded for your sports hobbies: for the purchase of subscriptions to sports clubs and swimming pools, sportswear and other sports goods. You can transfer any number of points to the card at the rate of 1 point = 1 ruble.

Detailed conditions and a complete list of MCC codes for which increased points are awarded are posted on the product page

In Yaroslavl and the Yaroslavl region:

Yaroslavllift JSC (operation 10105 in the PSB-Retail Internet bank), Volzhsky Management Company LLC (operation 10133 in the PSB-Retail Internet bank), Zapad Management LLC (operation 10134 in the PSB-Retail Internet bank), Yaroslavl EIRC Uglich (operation 7063 in the PSB-Retail Internet bank), Gazprom Mezhregiongaz (operation 5715 in the PSB-Retail Internet bank)

Changes and clarifications in the conditions for Orange Premium Club customers

From 01/01/2021, the categories of 5% and 10% have been expanded, and an option has been added up to 2% for everything.

Cashback conditions for OPC clients:

– 10% in the selected category for spending from 80,000 rubles. per month on ORS cards

— 5% in the selected category when spending from 10,000 rubles. per month on ORS cards

OR

– Up to 2% for everything with spending from 80,000 rubles. per month on OPC cards (1% for spending over 10,000 rubles per month on OPC cards, 1.5% for spending over 50,000 rubles per month on OPC cards)

When calculating the amount of purchases, transactions made using MCC codes that are included in the list of exceptions (section 4 of the Program Terms) are not taken into account.

You can also join it on your own in Internet banking or by calling our contact center at 8 800 333 52 42